QuickBooks Self-Employed app for iPhone and iPad

Developer: Intuit Inc.

First release : 30 Aug 2014

App size: 427.36 Mb

Be ready for tax time - Expenses, Mileage & Invoice all in one place. Maximise your tax deductions and reduce paperwork!

QuickBooks Self-Employed helps you stay in control of your business finances for tax time by categorising expenses, invoices, receipts and mileage / kilometres (KMs) for your tax return. Invoice on the go and get paid faster and never touch a logbook again with Quickbooks Self-Employed.

Log everything you need for your vehicle budget, to remain in compliance with the ATO, all from your mobile device.

If you are freelancing or contracting, track all of your expenses, car mileage and invoices with QuickBooks Self-Employed. Receipt tracker allows you to attach receipts to expenses. Contractors, freelancers and company managers - maximise your tax deductions and tax returns.

Vehicle owners, contractors, business owners, freelancers and working individuals will find QuickBooks Self-Employed fast, easy and convenient – No training required. Snap receipts, track mileage and expenses, send invoices and stay in control of your finances to maximise your tax deductions and return.

QuickBooks Self-Employed Saves Time For:

• Contractors

• Business owners

• Freelance workers

• Sole traders

• Self-Employed

QuickBooks Self-Employed Features

Untangle Expenses on the go

• Connect your bank account so you can easily categorise expenses

• Separate business from personal expenses with just a swipe

Never Touch a Logbook Again

• QuickBooks Self-Employed stores your driven kilometres automatically, so you can easily log your mileage and stay on top of your vehicle budget.

• Every 1,000 KMs in your log, equals $660 in potential tax deductions

• Automatically track your kilometres- no need to fill in a paper log book

• Maximise your tax deductions with your automatically tracked driven kilometres!

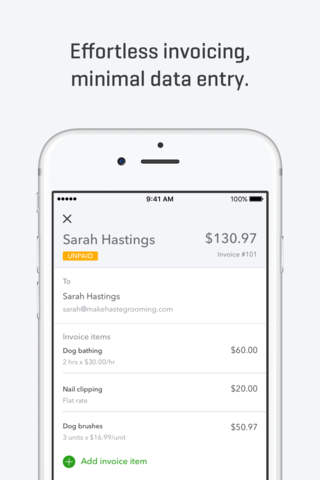

Invoice Maker

• Create and send invoices on the go

• Easy invoice creation – Make and send invoices in a few taps

• Invoice your clients with professional-quality documents

• Track when your customers viewed your invoices

Snap and Store Receipts

• Track expenses on the go and store receipts for tax time

• Easily snap and digitally organize your receipts

Accounting Help for ATO Taxes

• Accounting doesn’t have to be hard when you’re a sole trader. QuickBooks Self-Employed app does the math for you and helps you maximize your tax refund.

• Tax calculator tracks your expenses, receipts and more to make the ATO tax a breeze.

Best of all, your financial data is safe and secure. QuickBooks Self-Employed is exclusively for contractors, freelancers, and sole traders.

Download QuickBooks Self-Employed, the quick and easy tracker for mileage, expense costs and receipt data.

Price, availability and features may vary by location. Subscriptions will be charged to your credit card in your iTunes Account at confirmation of purchase. Your subscription will automatically renew monthly unless canceled at least 24-hours before the end of the current period for the same amount that was originally purchased. You may manage your subscriptions and auto-renewal may be turned off in Account Settings after purchase. Any unused portion of a free trial period will be forfeited after purchasing a subscription. QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint.

To learn how Intuit protects your privacy, please visit http://security.intuit.com/privacy

For Terms of Service, visit www.intuit.com.au/terms